31+ estimate mortgage pre approval

Keep in mind that if your down payment is less than 20 of the price of your home youll need to purchase mortgage default insurance which can be added to the principal amount of your mortgage. Web The last section of the mortgage pre-qualification and affordability calculator will give you a total monthly payment and amountbroken down into principal interest taxes and insurance detailthat you can afford based on the information you provided.

Can I Afford To Buy A Home Mortgage Affordability Calculator

This mortgage prequalification calculator gives you an estimate of how much you can borrow which will help you narrow down your home search to properties that fit within your budget.

. It tells a buyer which mortgages they can use and how much house they can buy. Web Loan prequalification calculator terminology In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification calculator. Web Mortgage Pre-Approval Calculator.

From the mortgage amount you can then calculate how much purchase price you qualify for depending on your down payment. Pre-qualifying can help you have an idea of your financing amount and the process is usually quick and free but you wont know if you actually qualify for a mortgage until you get pre-approved. Web A mortgage pre-approval calculator will let you know approximately how much mortgage you can qualify for based on your income.

Web A mortgage pre-approval is the questionnaire thats the first step in buying a home. Web You can calculate affordability based on your annual income monthly debts and down payment or based on your estimated monthly payments and down payment amount. Web This Mortgage Pre-Approval Calculator helps you estimate your pre-approval amount based on your income and financial situation.

Web Mortgage pre-qualification is an informal evaluation of your creditworthiness and how much home you can afford based on self-reported information like your credit debt income and assets. Enter a higher amount for cash on hand to maximize your qualification amount. Web Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan as well as tell you the maximum amount you can afford and how much you can be pre-qualified to borrow.

Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Real estate agents often ask to see your letter before showing you houses as it demonstrates that youre a serious buyer. Calculate What You Qualify For First.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability including specific amounts of property taxes homeowners insurance. Rocket Mortgage Loan Requirements My Monthly Rbc. Lenders look at income debts down payment credit score employment history and bankruptcy history to determine whether you are eligible for pre-approval.

Web The prequalification that you receive from a lender may differ from this estimate based on the lenders requirements for loan approval. 1 million or more. Web The loan estimate will provide details about your loan including your monthly mortgage payment interest rate and closing costs based on your pre-approved loan amount.

Keep your pre-approval letter handy. Your lender will also be able to help you understand how taxes and insurance will affect monthly mortgage payments in. With their mortgage pre-approval completed buyers can shop confidently knowing that their offer to purchase a home will get approved.

Web With pre-qualification the lender provides the mortgage amount for which you may qualify. Lenders such as Rocket Mortgage look at your income assets and credit score and determine what loans you could be approved for how much you can borrow and what your interest rate might be. I want to mention one thing here.

Web If youre pre-approved for a mortgage your loan file will eventually transfer to a loan underwriter who will verify your documentation against your mortgage application. You can purchase a 484000 home. Web Mortgage preapproval is the process of determining how much money you can borrow to buy a home.

Web View our mortgage pre-approval checklist to see what info and documentation youll need to supply. Web 10 for the portion of the purchase price above 500000. Your purchase price is limited by available cash on hand for downpayment.

But our chase home affordability calculator can help refine and tailor the estimate of how much house you can afford based on additional factors. 20 of the purchase price. Try our calculator below.

Mortgage Pre Approval How To Get Pre Approved For A Home Loan

Mortgage Pre Approval Calculator Casaplorer

Explore The 2020 Wellbeing Sector

Sec Filing Investor Relations Luther Burbank Corporation

How And Why To Get Pre Approved For A Mortgage

Mortgage Loan Prequalification Calculator Propertynest

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Indispensable Real Estate Buyers Agent Checklist For Homebuyers True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Step 3 Get Pre Approved For Your Mortgage Your Lower Al Agent

How To Get A Mortgage Pre Approval Credible

What Exactly Do You Get Pre Approved For Mortgage Blog

Mortgage Broker In Birkdale Thornside Wakerley Mortgage Choice

G201504061231506422617 Jpg

Mortgage Pre Qualification Calculator Nerdwallet

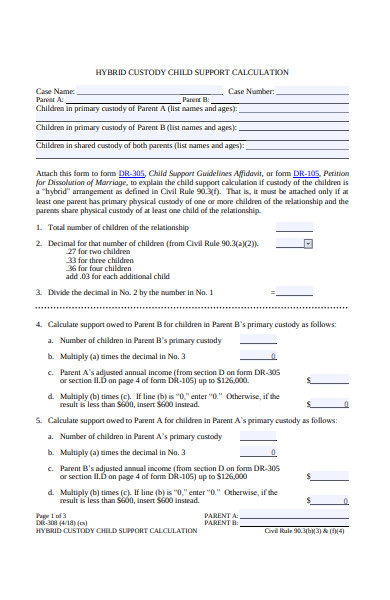

Free 31 Calculation Forms In Pdf Ms Word

Designation Process In The Bop

The Mortgage Brothers Show Signature Home Loans Phoenix Az